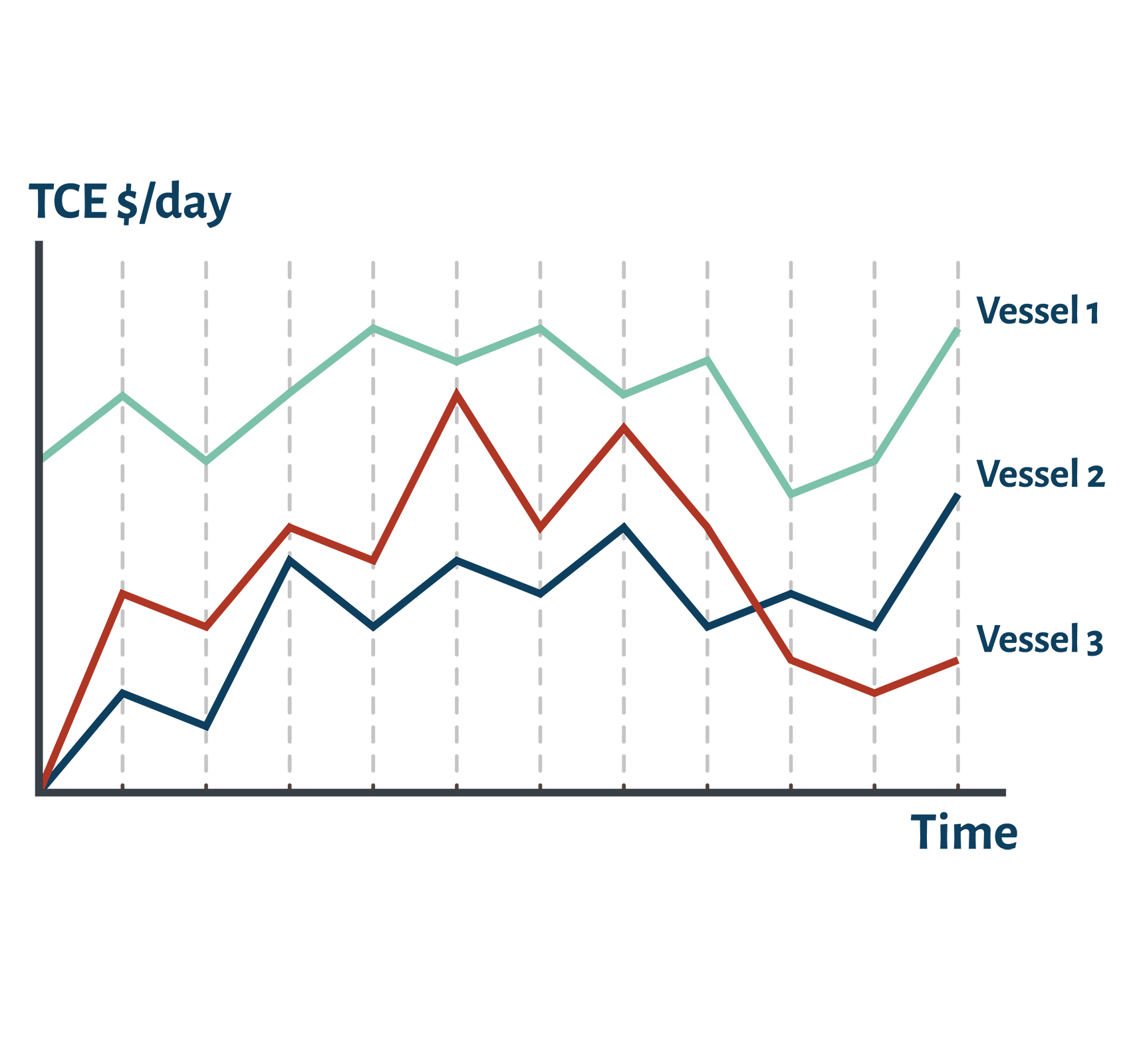

Time Charter Equivalent (TCE) is a key term used in the shipping industry. It indicates the average daily revenue earned by a ship. TCE is calculated by subtracting voyage expenses from total revenue. Then, the result is divided by the number of days in the voyage. The final value is expressed in US dollars per day.

This standard measure allows a consistent earnings comparison for different voyages, vessel types, charter types, and different periods. This helps shipping companies to evaluate profitability and make informed decisions on fleet management and chartering.

TCE is a fundamental term for chartering people in the shipping industry. It is used to determine the economics of a specific vessel on a specific route for a defined period. It gives a US dollars per day value that is used for understanding the cost/profit structure.

Shipowners, or operators aim to understand their fleets better and improve their bargaining power. Charterers also use this term to identify the freight economics of their potential cargoes.

In his book “Maritime Economics” (2009), Martin Stopford explains the concept of Time Charter Equivalent (TCE). He describes TCE as a way to convert the spot freight rate (e.g., $20 per tonne for a 40,000-tonne cargo) into a daily hire rate for a voyage (e.g., $20,000 per day). This conversion is achieved by deducting voyage costs from the gross freight and dividing the result by the total number of days on the voyage, including any necessary ballast time.

Calculation of Time Charter Equivalent

(Cash Generated by Voyage (less OPEX) / Days on Voyage) + Operating cost $/day

To find the Time Charter Equivalent, we need to identify the main expenses in the shipping industry. These costs apply to both voyage and time charter.

These basic terms are as follows: Operating cost $/day, Voyage duration(ballast and laden), Freight earnings in $/pmt, Brokerage commission, Bunker cost, Port costs & Canal dues, Operation Cost (OPEX), and Voyage cashflow.

- Operating cost $/day (OPEX): Ship operating expenses (OPEX) encompass various costs required to keep a vessel operational and efficient. OPEX incurs whatever trade the ship is engaged in. These include crew salaries, insurance premiums, stores (supplies and provisions), maintenance (drydocking, special survey and repairs), and administrative expenses. Effective management of these expenses is crucial for maintaining profitability and ensuring the smooth operation of maritime operations.

- Voyage duration(ballast and laden): The total voyage duration includes both the laden segment, where the ship is carrying cargo, and the ballast segment, where the ship returns empty to pick up the next cargo.

- Freight earnings in $/pmt: Freight earning means that the gross revenue is calculated by multiplying freight $/pmt by total cargo quantity in mt. This calculation gives the gross freight revenue or freight earnings.

- Brokerage commission: Brokerage commission is a fee paid to brokers for facilitating the charter agreement between shipowners and charterers. In voyage chartering, it is usually a percentage of the freight earned, paid by the shipowner. In time chartering, the commission is a percentage of the hire rate, deducted from the daily hire payments over the charter period. Brokers are essential in negotiating terms and ensuring the agreement suits both parties, making their commission an integral part of shipping operations.

- Bunker cost: Bunker cost refers to the fuel expenses incurred by a ship during its voyage. These expenses fluctuate based on fuel prices, consumption rates, and voyage length. Effective management of bunker costs through route optimization and fuel efficiency is essential for maintaining profitability in shipping operations.

- Port costs & Canal dues: Port costs and canal dues are significant expenses incurred during a ship’s voyage. Port costs include fees for using port facilities, such as docking, loading, unloading, mooring and services like pilotage and towage. Canal dues are charges for transiting through canals like the Suez or Panama Canal. These costs also include Turkish Straits Transit Passage costs as well.

- Voyage cashflow: Voyage cashflow measures the net cash generated from a maritime voyage after all related expenses. It starts with gross freight earnings and deducts the broker’s commission, voyage costs (such as fuel, port fees, and canal dues), and operating costs. This final figure provides a clear picture of the voyage’s profitability, aiding in strategic planning and financial management.

The formula is as below,

Time Charter Equivalent (TCE) $/day = (Voyage cashflow / Days on the voyage) + OPEX $/day

”Mastering Time Charter Equivalent (TCE) is key to maritime excellence. By analyzing costs like OPEX, voyage duration, freight earnings, and bunker costs, shipping companies can boost financial performance and strategic planning. Accurate TCE calculation ensures peak efficiency and profitability, driving superior decision-making in a competitive industry.

Understanding the calculation of Time Charter Equivalent (TCE) is crucial for optimizing maritime operations financially. Shipping companies can boost their financial performance by examining various costs. These costs include operating expenses, voyage duration, freight earnings, brokerage commissions, bunker costs, port costs, and canal dues.

By analyzing these expenses, companies can identify areas for improvement. This can lead to increased profitability and efficiency in their operations.

Effective management of these elements ensures smoother operations and maximizes profitability, ultimately contributing to better strategic planning and decision-making in the competitive shipping industry. The TCE formula encapsulates this comprehensive approach, providing a clear metric for evaluating voyage profitability as well as a comparison point for various setups.

The Choice of Speed and Time Charter Equivalent (TCE)

Slow Speed or Full Speed?

Choosing the speed for a vessel is not as simple as it seems. The biggest cost for a voyage is fuel, which increases as the speed of the ship increases. In some cases, charterers may request the vessel to proceed at full speed to the discharging port. This requirement is mostly needed either to catch a berthing window or avoid stock-out risk of the product carried by the ship at the receiver’s site.

The shipowner or time charterer chooses the speed for the ballast voyage when the ship is empty. Slower speeds save money on fuel but take longer to reach the destination. Faster speeds use more fuel and cost more.

The Time Charter Equivalent (TCE) is significantly impacted by these speed choices. Sailing slower saves money on fuel, which increases profit. However, it also means that the profit spreads out over more days, which could lower the overall earnings.

To manage speed effectively, it’s important to balance saving fuel with the impact on the total cost of ownership. Additionally, consider the cost of lost days that you could use for other voyages. Also, consider the cost of lost days that could be used for other voyages. Therefore, in most cases, when the market is high, meaning that the time charter rates are high, owners tend to navigate at full speed.

Examples of TCE Calculation

Handysize, and Panamax

Example 1: Time Charter Equivalent Calculation for a Supramax Vessel

For a Supramax vessel, let’s assume the following voyage details.

Cargo Intake: 50.000 mts bulk cargo

Freight Pmt: USD 17,50 / pmt

Voyage Duration: 37 Days

Operating Costs: USD 4.000,00 / Day

Freight Earnings: USD 875.000,00

Less Brokerage Commission: USD 10.937,50 (1,25%)

Less Voyage Costs: USD 273.000,00

Less Operating Costs: USD 148.000,00

Voyage Cashflow: USD 443.062,5

Time Charter Equivalent: USD 15.974,67 / Day

(USD 443.062,5 / 37) + USD 4.000,00 / Day

Example 2: Time Charter Equivalent Calculation for a Handysize Vessel

For a Handysize vessel, let’s assume the following voyage details.

Cargo Intake: 27.000 mts bulk cargo

Freight Pmt: USD 21,00 / pmt

Voyage Duration: 28 Days

Operating Costs: USD 2.500,00 / Day

Freight Earnings: USD 567.000,00

Less Brokerage Commission: USD 7.087,50 (1,25%)

Less Voyage Costs: USD 185.000,00

Less Operating Costs: USD 70.000,00

Voyage Cashflow: USD 304.912,5

Time Charter Equivalent: USD 13.389,74 / Day

(USD 304.912,5 / 28) + USD 2.500,00 / Day

Simple TCE Calculator

In conclusion, understanding and calculating the Time Charter Equivalent (TCE) is essential for optimizing maritime operations and benchmarking during decision-making. For example, a shipowner may decide which cargo pays better by comparing the TCE of each voyage for his ship. TCE provides a standardized metric that allows shipping companies to compare the profitability of different voyages and vessel types.